MARKETS IN A MINUTE: RECESSION? DOES IT MATTER?

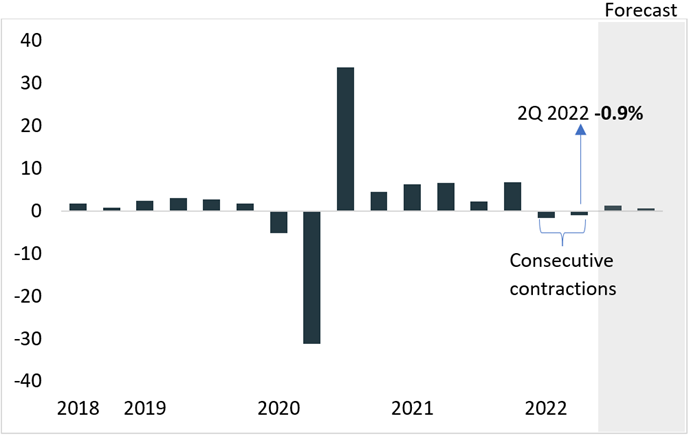

Last week, the Bureau of Economic Analysis reported that the US economy was estimated to have declined for the second quarter in a row, after adjusting for inflation. The data release prompted the word “recession” to spring up in headlines right and left, leaving some investors wondering if they should head for the hills. But before anyone hits the panic button, remember that by the time a recession is actually called, most of the damage in the markets has already happened.

What do we actually know about economic growth?

What do we actually know about economic growth?

- Second quarter real GDP growth was estimated to have fallen by 0.9% on an annualized basis, after having fallen by 1.6% in the first quarter.

- These numbers try to adjust for the overall rise in prices, meaning that the economy overall grew, but only because of the high rate of inflation.

- While housing activity and government spending declined slightly, the largest drag on growth came from companies that raised inventories at a slower pace than previous periods.

- Net exports improved after several quarters of declines. Consumer spending, though positive, grew at a slower pace.

U.S. GDP, change from previous quarter

What exactly is a recession anyway? (Nerd alert! Feel free to skip the following if you’re not interested in the nitty gritty.)

- Colloquially, two consecutive quarters of negative economic growth is often referred to as a recession. But the actual timing and determination of what constitutes a recession is a bit more complicated.

- The National Bureau of Economic Research (NBER) is the official arbiter of when a recession is said to have started and ended. The NBER’s Business Cycle Dating Committee defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” They look at a depth, diffusion and duration across a variety of factors.

- Unlike GDP, which is calculated by the quarter, the NBER’s recession dating goes by month, making it a more precise measure, if more qualitative.

Should investors care if and when a recession is called? There are reasons to not pay too much attention.

- Both GDP numbers and the NBER’s dating of recessions come at a lag, sometimes a significant one. GDP growth estimates can also change, sometimes meaningfully and sometimes for quarters or years to come. So, what initially gets reported as a decline in economic activity can later be changed to an increase, and vice versa.

- Most importantly, the market moves much more quickly than the BEA or NBER. Stock prices tend to reflect the economic environment months in the future, or, at least, what they think will happen. Stocks are often wrong about what is to come.

“Wall Street indexes predicted nine out of the last five recessions! And its mistakes were beauties.”

- Paul Samuelson, winner of the Nobel Prize for Economic Sciences

- Paul Samuelson, winner of the Nobel Prize for Economic Sciences

With the S&P 500 having fallen more than 20% from its peak, the market has already priced in significant slowing of economic activity. Investors should do well to remember that the stock market is willing to sacrifice being wrong in favor of being quick, whereas the BEA and NBER choose accuracy over timing. So, the official signal that the economy is in recession often comes when it doesn’t matter anymore to the market.

Instead of worrying about recessions, we recommend a back-to-basics approach that ensures portfolios are properly diversified and take a level of risk that makes sense for the individual’s goals, risk level and time horizon. Focus on companies with attractive valuations and high-quality earnings. These types of businesses have a history of withstanding short-term vagaries in the market and reliably delivering returns to shareholders even when the road gets bumpy.

As we’ve written before, and likely will again, if you’re fretting about market gyrations, take your portfolio in for a checkup. Your advisor can ensure that your portfolio is properly aligned with your risk tolerance, which is key to meeting your financial goals.

Live richly and invest well,

As we’ve written before, and likely will again, if you’re fretting about market gyrations, take your portfolio in for a checkup. Your advisor can ensure that your portfolio is properly aligned with your risk tolerance, which is key to meeting your financial goals.

Live richly and invest well,

Kara

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Private Wealth Services, LLC, Kestra Investment Services, LLC, Kestra Investment Management, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Private Wealth Services, LLC, Kestra Investment Services, LLC, Kestra Investment Management, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC does not offer tax or legal advice.